Forex Fibonacci Book. Series of Free Forex ebooks

Educational guide on using Fibonacci method. Free Forex Fibonacci tutorial

Forex Fibonacci Book. Series of Free Forex ebooksEducational guide on using Fibonacci method. Free Forex Fibonacci tutorial |  |

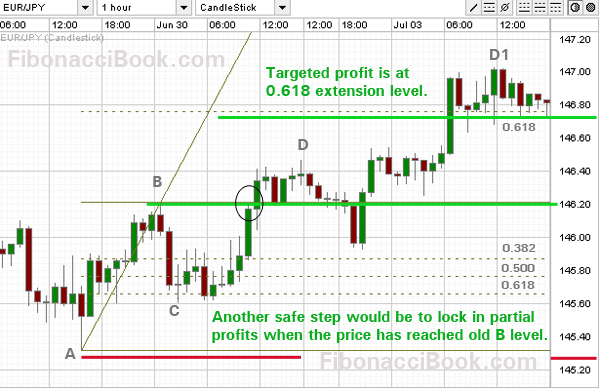

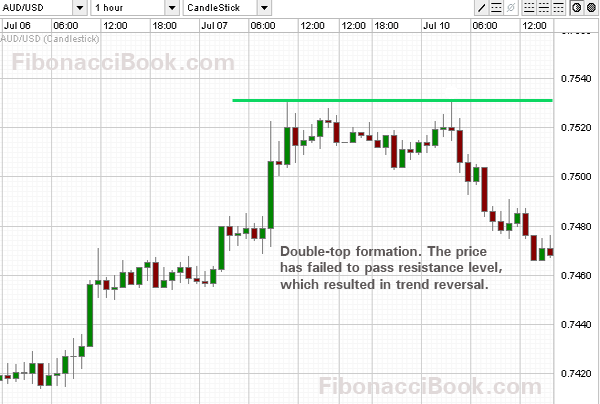

4. Fibonacci Defines Profit taking levels — sets objectivesFibonacci extension levels — 0.618, 1.000 and 1.618 — are used to set profit goals. After placing entry orders traders simply need to look at extension levels and set «take profit»/ «close trade» orders. In more than 50% of cases traders tend to choose 0.618 extension level as a primary target to lock in profits. If the market is very active, traders can simply reset their positions and ride the market further to the next 1.000 or even 1.618 Fibonacci extension level. For traders who like to take additional protective steps and trade safe, there is one more point to consider such as locking in some partial profits during the trade.  If we return to the moment when price has just reached the mark of old B point, we should remind ourselves that in order to confirm its uptrend (as shown in our case) the price will need to pass old B point (B swing high) and move further up. Violation to pass B point will create a double-top formation, which is a strong signal of potential trend reversal. That's why locking some partial profits at this old B point will make our trade profitable even if the market decides to turn in the opposite direction.

| |||||||||||||||||||||||||

Copyright © 2006 — 2023 Fibonaccibook.com Forex trading is a high risk investment. All materials are published for educational purposes only. |